1. Work during Child Care Leave and Benefits

The rule regarding child care leave benefits in case of work during leave was revised as of October 1, 2014.

There are cases when workers taking child care leave are employed temporarily due to shortage of the workforce or back up for busy season. Also, employees who have professional skills or work as management positions are occasionally requested to word during child care leave period.

For those reasons, under certain conditions of working days and hours, child care leave benefits are fully paid even if employees work temporarily during leave. This rule has been eased at the revision dated October 1, 2014, and the benefits are now paid if working hours are within a certain amount of time regardless of working days.

Thus, employers are recommended to hire workers on child care leave by checking their working days and hours, as well as salaries (wages), which will affect the amount of the benefits. In addition, from the point of human resource management, temporary work during leave should be clearly separated from regular employment or comeback from leave. Please consider that child care leave benefits are qualified for those workers who are actually taking leave.

Therefore, please keep in mind that this column is aimed for temporary work during child care leave period.

2. Child Care Leave Benefits

When a person covered by employment insurances takes child care leave, he/she is eligible for “child care leave benefits” if there are at least 12 months in total, during the two years preceding the date on which the leave starts, in which the number of days on which his/her wage payment is based is 11 or more. The benefits are provided for a worker who takes child care leave to take care of his/her child under one year of age (or one year and two months, or one year and six months in specific cases).

In the revision of Child Care Leave Law dated April 1, 2010, the “basic child care leave benefits” and the “work resumption after child care leave” got consolidated, and the “child care leave benefits” are now paid during leave.

The amount of child care leave benefits during the base paid period (one month, in principle) is principally calculated as follows:

The amount of the benefits= daily wages at the start of leave x paid days x 67% (NOTE 1) (50% after six months of leave)

(NOTE1) For those workers who started leave on and after April 1, 2014. For those who started leave on and before March 31, 2014, 50% is applied through entire leave period.

3. Working Days and Hours during Leave

Before revision, the benefits were not paid for the cases of 11 or more of working days during leave regardless of working hours.

This rule has been revised, and the benefits are now paid if working hours for the base paid period (one month) are 80 hours or less, irrespective of working days.

The pay of the benefits depends on working days and hours as follows:

● 10 days or less for working days→ paid

● 11 days or more for working days + 80 hours or less for working hours → paid

● 11 days or more for working days + over 80 hours for working hours → not paid

4. The Amount of Child Care Leave Benefits

In principle, the amount of the benefits is calculated as follows:

Daily wages at the start of child care leave x paid days (hereinafter, [A]) x 67% (NOTE2)

(NOTE2) 50% after six months of leave

If wages are paid for work during leave, the following restrictions are applied:

(1)If the wages paid for work during leave exceeds 13% of [A], the amount of the benefits is reduced as follows:

The reduction amount = (the wages paid for each base paid period (one month, in principle) + 67% (50% after the six months) of [A] -80% of [A]

(2) If the wages paid for work during leave is 80% or more of [A], the benefits are not paid.

(NOTE3) Summary of the above (1),(2)

The benefits set up an upper and lower limit. The maximum amount of the “monthly wages” (daily wages at the start of child care leave x 30 days) set JPY426,000. Thus, the upper limit of the benefits is JPY285,420 (JPY426,000 x 67%) for the first six months and JPY213,000 (JPY426,000 x 50%) after the six months. On the other hand, the minimum amount of the “monthly wages” is JPY69,000. (NOTE4)

(NOTE4) The maximum and minimum amounts of the “monthly wages” will be changed on August 1 every year. JPY 426,000 and JPY69,000 remain in effect until July 31, 2015.

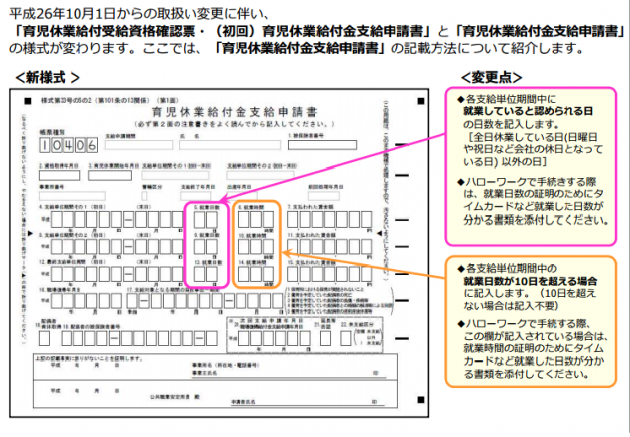

5. Changes of Application Forms

Along with the above revision, from October 1,2014, the forms of “the confirmation sheet of qualification of child care leave benefits ・(first time) the application for child care leave benefits” and “the application for child care leave benefits” have been changed. For the cases of more than 10 working days, you are requested to submit the documents such as time cards, payroll books, rules of employment, etc. together with those applications. The new application form is illustrated below.

In the new application form, please check below:

● Fill in the number of working days (excluding non-business days and holidays) for each base paid period.

● For the procedures at Hello-Work, attach the documents showing your working days such as time cards.

● In case of more than 10 working days, fill out your working hours. (not required if your working days are 10 or less.)

For more details, please visit the website of the Ministry of Health, Labour, and Welfare. If you need further information of child care leave benefits and other social security procedures, please feel free to contact us.

育児休業給付の内容および支給申請手続きについて

Child Care Leave Benefits and Procedures for Application

https://www.hellowork.go.jp/dbps_data/_material_/localhost/doc/ikuji_kyufu.pdf

育児休業給付金の取り扱いの変更について(平成26年10月1日から)

Revision of Child Care Leave Benefits (From October 1, 2014)

http://www.mhlw.go.jp/file/06-Seisakujouhou-11600000-Shokugyouanteikyoku/0000042797_2.pdf

Query on the phone+81-3-6821-9455