News Details

2018.01.31

Virtual Currency Gains Classified as “Miscellaneous Income”

- Calculation Method on Individual Income Tax Return-

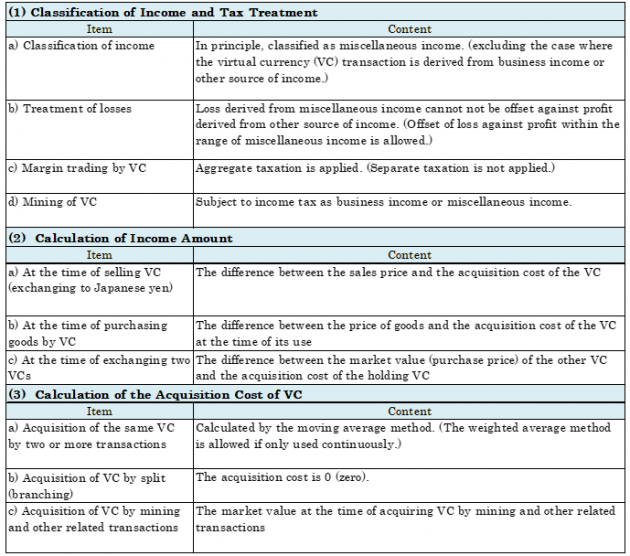

On December 1, 2017, the National Tax Agency (NTA) revealed the tax treatment and calculation method of gains and losses obtained from virtual currency transactions, which are subject to income tax at the individual level. Specifically, you need to file the final tax return in cases where you sell, use (purchase goods by virtual currencies), and exchange (exchange to other virtual currencies) virtual currencies. The details are as follows.

(1) Classification of income related to virtual currency and tax treatment

(2) Calculation method of income at the time of selling or exchanging virtual currency

(3) Calculation method of the acquisition cost of virtual currency

There has been a lack of information about the treatment of income on virtual currencies under the Japanese income tax law. But the NTA revealed that gains derived from virtual currency transactions are classified as miscellaneous income and subject to an individual income tax. For those who need to file the final return, please refer to the table below.

Please note that this News only introduces general outlines and does not include professional advice. So please make sure not to make any decisions without taking professional advice individually. If you have any questions, please feel free to contact us.

(Reference) Information about calculation method, etc. of income on virtual currency

(Information in Japanese)

https://www.nta.go.jp/shiraberu/zeiho-kaishaku/joho-zeikaishaku/shotoku/shinkoku/171127/01.pdf

Accessed on January 31, 2018

Query on the phone+81-3-6821-9455