News Details

2015.04.01

Ark’s Vision for the Social Security and Tax Number System- Introduction

1. Introduction

“The Act on the Use of Numbers to Identify a Specific Individual in the Administrative law” has been enacted on May 24, 2013. It is so called “My Number System” in Japanese, and your Individual Number will be used in the areas of tax and social security from January, 2016.

Lately, the topic of the Number System has been picked in the media or the government related website, and the accounting and administrative persons in charge in private companies are paying more attention to handling of employees’ Individual Numbers.

We, Ark Outsourcing, have set up a special team for the Number System. It is essential in doing our outsourcing services including payroll and social services. We will enhance our business related to individual information and provide you services along with the guidelines under the Number System.

2. What is “Individual Number”?

You will receive a “notification card” noting your Individual Number from your municipal office in and after October 2015. Individual Numbers are issued not only to Japanese who have resident records, but foreigners such as medium- to long-term residents, special permanent residents, etc.

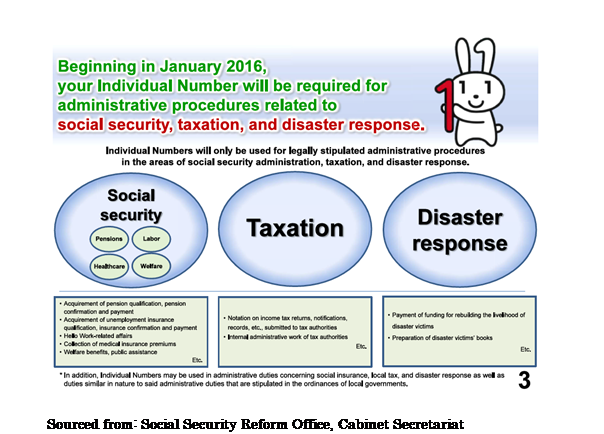

The number on the notification card is called “Individual Number”, which will be used identifying individuals in administrative duties such as taxation, social security, and disaster response. From now on, the Individual Numbers will be used widely in society and treated as important information in the same way as persons’ names and addresses.

3. Impact on Private Companies

Beginning in January, 2016, “Individual Number” is required for administrative procedures related to tax and social security. In principle, you will present your Individual Number in submitting certificates or notices to tax offices or pension offices, etc. Thus, private companies must also receive the Individual Numbers of employees and their dependents in their administrative operations.

In addition, the acquisition, use, or provision of the Individual Numbers for any duty that is not stipulated by law is prohibited; it is illegal that “I’ll just get my Individual Number even if I do not know when to use it”.

Furthermore, private companies must dispose or delete their employees’ Individual Numbers from the documents they made for the social security and tax purposes as soon as possible, after the certain period stipulated by laws and regulations.

Thus, the Individual Numbers will obviously increase burden of private companies because of the strict regulations on their acquisition, use, provision, maintenance, and disposal.

4. Conclusion

Your Individual Number is treated as specific personal information, and it has some regulations and penalties to protect it from leakage or misuse. For example, if an administrative employee intentionally leaks the information of the Individual Numbers, the penalties shall be imprisonment with work for no longer than four years or a fine of no more than two million yen.

Even though an employee misuses or leaks the information, his/her company is also punished as his/her regulatory authority. Thus, it is inevitable for private companies to manage the risk in handling the Individual Numbers.

We will carefully discuss the measurement of the Individual Numbers with our clients and provide the best service suitable for each client. We will support you and your company with our safely-managed environment and make every effort to prevent from any risk surrounding the Individual Numbers. If you have any questions, please feel free to contact us.

(Reference)

The Social Security and Tax Number System (Cabinet Secretariat HP)

http://www.cas.go.jp/jp/seisaku/bangoseido/english.html

The Overview of the Specific Personal Information Protection Commission (Specific Personal Information Protection Commission HP)

http://www.ppc.go.jp/en/

Query on the phone+81-3-6821-9455