1. Introduction

In the FY2016 tax reform, the corporate and individual income tax treatment of directors’ compensation (so called, Japanese Restricted Stock) was partly amended. Starting from FY2006, the amendment in FY2016 is the drastic tax reform of directors’ compensation, which allows Japanese domestic companies to introduce new incentive awards aiming for the mid to long term corporate growth. In this News, we will mention a new tax treatment that Specified Restricted Stock (“SRS”) is included in pre-determined compensation with advance notice as deductible expenses under the Japanese Corporation Tax Law.

2. Previous treatment of directors’ compensation

Before the FY2006 tax reform, directors’ bonus was treated as appropriation of retained earnings and not deductible as expenses for corporate tax purposes. In addition, directors’ retirement payment was deductible except for the unreasonably high amount. Such tax treatments before the FY2006 reform were affected by Commercial Code of Japan and the corporate accounting rules at that time, in which the directors’ bonus was considered appropriation of retained earnings and not characterized as expenses.

The FY2006 tax reform brought an idea that directors’ bonus is treated as the cost for services rendered by directors and included in deductible expenses under certain conditions. In detail, the directors’ compensations meeting either of the following conditions are deductible as expenses: ①fix amount periodical compensation; ② pre-determined compensation with advance notice; or ③ profit-based compensation.

3 Treatments of “SRS” (FY2016 Tax Reform)

The FY2016 tax reform has set the new corporate and individual tax rule for “SRS” as Japanese Restricted Stock.

In light of the proposals regarding the necessity of promoting directors’ incentive awards under corporate governance, the FY2016 tax reform has spotlighted equity compensations, which enhances directors to make more growth-oriented management from the shareholders’ perspective. In detail, the FY2016 tax reform allowed that Japanese domestic companies could include “SRS” under certain conditions in pre-determined compensation with advance-notice as deductible expenses.

(1) What is “SRS”?

“SRS” is a stock satisfying the requirements for “SRS” which also covers the requirements for “restricted stock”.

(2)Requirements for restricted stock

・Transfer of stock is restricted for a vesting period.

・The domestic company (the “Company”) stipulates specific reasons such as each director’s working condition or performance expectation in cases where stocks are forfeited without consideration.

(3) Requirements for “SRS”

・The stock is granted in exchange for the director’s compensation claim for providing services to the “Company”.

・The issued restricted stock is the stock of the “Company” receiving services from the director or its 100% parent company.

(4) Procedure qualified as “pre-determined compensation with advance notice”

The “SRS” granted to the directors under the following conditions is treated as pre-determined compensation with advance notice; however, the advance notice to the tax authority is not required.

・The payment amount of the compensation claim for the director’s future performance is fixed.

・The “SRS” is issued by a certain period of time in exchange for the contribution in kind of the compensation claim for the services rendered from the director.

・Each director’s fix amount of compensation is resolved by the shareholders’ meeting within one month from the starting date of the director’s execution of services (i.e. the date of the shareholders’ meeting).

・ Upon the above rules, the “SRS” is granted within one month from the date of resolution.

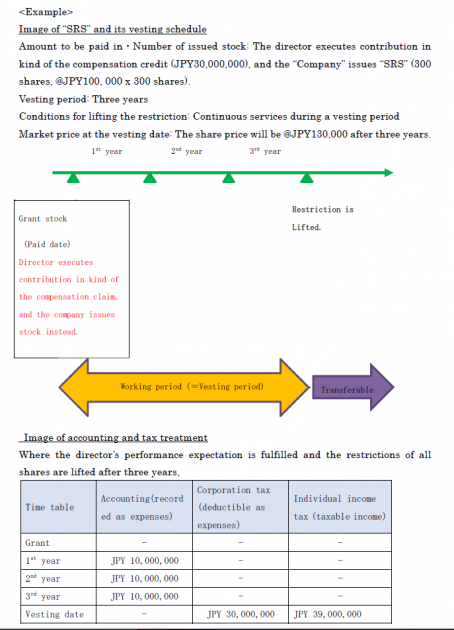

4. Accounting and tax treatment

(1) Accounting treatment

Where the “Company” issues “SRS” in exchange for the contribution in kind of the compensation claim from the director, the transaction is recorded as follows:

Issue date: Pre-paid expenses (the compensation claim) XXXX / Capital XXXX

Vesting period (allocate the compensation claim based on the portion of services rendered through a vesting period and recognize as expenses):

Expenses XXXX / Pre-paid expenses XXXX

(Other accounting treatments are also available such as recognizing expenses at the time of granting.)

(2) Corporate tax treatment

Individual income taxation (※) occurs to directors when the restriction is lifted. At the same time, the “Company” recognizes the cost for the services rendered by directors as a deductible expense for corporate tax purposes.

(※) Salary income, enterprise income, retirement income and miscellaneous income under the Individual Income Tax Law trigger taxation.

(3) Individual income tax treatment

Due to the restriction on transfer of “SRS” during a vesting period or a possibility of forfeiture, individual income taxation occurs to directors when the restriction is lifted. The taxable income is the market value of “SRS” at the vesting date.

5. Conclusion

In this News, we have mentioned directors’ stock-based compensation under the FY2016 tax reform. For your reference, we illustrate an example about the image of “SRS” below. Please note that this News only introduces general outlines and does not include professional advice. So please make sure not to make any decisions without taking professional advice individually. If you have any questions, please feel free to contact us.

(Reference)

Ministry of Economy, Trade and Industry Website A report titled “Guidebook for Introducing New Stock-based Compensation (“Restricted Stock”) as Board Members’ Compensation to Encourage Companies to Promote Proactive Business Management”

http://www.meti.go.jp/press/2016/04/20160428009/20160428009.html

Accessed on November 23, 2016

Query on the phone+81-3-6821-9455