News Details

2016.04.30

Introduction of Reduced Tax Rate System in Consumption Tax Reform for 2016

1. Overview and background of introduction

The tax reform bill for 2016 was enacted on 29 March, in which a reduced consumption tax rate was introduced. In order to maintain financial health of the Japanese economy and secure trust from the market and international society, a consumption tax rate is expected to rise to 10% (as of 8 April 2016), starting in April 2017. The reduced consumption tax rate system aims to protect low-income people from the impact of the increase of the tax rate. Although there are still many concerns about the timing of raising the tax rate, we will mention the reduced consumption tax rate system in this News.

2. Reduced consumption tax rate system

(1) Content

The reduced consumption tax rate system is to apply the current tax rate of 8% for the purchase of certain products such as food and beverages (excluding restaurant services), along with raising a consumption tax rate to 10%.

(2) Timing and qualified products

The reduced consumption tax rate system will be applied on 1 April 2017. Qualified products are as follows:

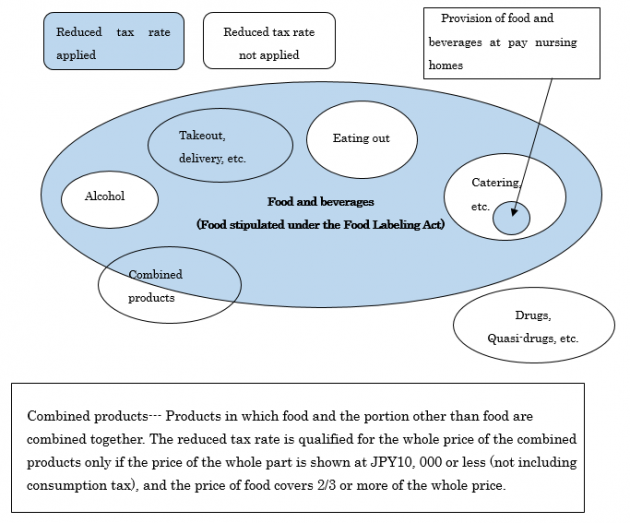

① Sale of food and beverages (food and beverages (excluding alcohol stipulated

under the Liquor Tax Law) stipulated under the Food Labeling Act and excluding

eating out, etc.)

② Sale of newspapers under contracts of subscribing at least twice a week

The current tax rate of 8% is applied to overall food which is possible to

take out except for alcohol and eating out, and newspapers.

(3) Details of qualified products (Please see the image picture below from the National Tax Agency, Q&A)

(4) Responses to difficult cases to judge

Whether a reduced tax rate is applied or not is judged at the time of consumers’ purchasing products. That is, it is judged when food, beverages, etc. are traded.

3. Examples of countries applying reduced tax rates (mainly Europe)

In European countries, reduced tax rates were already introduced in the 1970s. In such countries, they call the consumption tax in Japan as ‘Value-Added Tax (VAT)’, which is quite different from the Japanese consumption tax system because they set up different tax rates depending on products. VAT sets up tax rates based on the levels of added-values of products, which means daily necessities are liable for a reduced tax rate, while luxuries are liable for a higher tax rate.

For instance, in UK, even among the same categorized foods, delicatessens at supermarkets are subject to the reduced tax rate of 0%, whereas warm hamburgers are considered as luxuries and subject to the standard tax rate of 20%. Likewise in France, butter is imposed at the reduced tax rate of 5.5%, whereas margarine is imposed at the standard tax rate of 20%, which is due to the intention of protecting dairy farmers producing butter. As such, each European country sets up different VAT rates, considering various circumstances.

4.Conclusion

In this News, as previously mentioned, we have focused on the system of a reduced consumption tax rate itself and omitted the explanation of the related issues including the introduction of an invoicing system.

Please note that this News also introduces only general outlines of the content and does not include professional advice. So please make sure not to make any decisions without taking professional advice individually.

If you have any questions, please feel free to contact us.

(References)

● Ministry of Finance Japan “Outline of the FY2016 Tax Reform Proposals”

<https://www.mof.go.jp/tax_policy/tax_reform/outline/fy2016/20151224taikou.pdf#search='28%E5%B9%B4%E7%A8%8E%E5%88%B6%E5%A4%A7%E7%B6%B1>

Accessed on 27 March 2016

● Ministry of Finance Japan “Overview of Major Countries’ VAT”

<https://www.mof.go.jp/tax_policy/summary/consumption/108.htm>

Accessed on 3 April 2016

● Cabinet Office, Government of Japan “Products Qualified for Reduced Tax Rate”

<http://www.cao.go.jp/zei-cho/gijiroku/zeicho/2015/__icsFiles/afieldfile/2016/01/27/27zen29kai2.pdf> Accessed on 3 April 2016

● The Mainichi 16 December 2015

<http://mainichi.jp/articles/20151216/ddm/010/010/019000c>

Accessed on 27 March 2016

● NHK NEWS WEB 9 February 2016

<http://www3.nhk.or.jp/news/keigenzeiritsu/article04.html>

Accessed on 27 March 2016

● The Nikkei 8 April 2016

5. Financial News

● National Tax Agency “Information on the Introduction of a Reduced Tax Rate, Q&A”

<http://www.nta.go.jp/zeimokubetsu/shohi/keigenzeiritsu/pdf/02.pdf>

Accessed on 13 April

Query on the phone+81-3-6821-9455