1. Introduction

On 16 December 2015, the ruling coalition government (the Liberal Democratic Party and the New Komeito) released the 2016 Tax Reform Proposals (‘Proposals’), which were approved by the cabinet on 24 December 2015.

In the Proposals, the government aims to enhance pro-growth corporate tax reform. In details, the Proposals include reduction of the effective corporate tax rate, expansion of the tax base, introduction of lower consumption tax rate, and others measures.

In this News, we introduce major corporate tax reforms in the Proposals.

Please note that the content of the Proposals might partly change in the process of discussions in the Diet.

2. Corporate Taxation

(1) Reduction of effective corporate tax rate

In order to enhance pro-growth corporate tax reform, the corporate tax rate

(currently: 23.9%) is reduced gradually as below:

- Fiscal years beginning on or after 1 April 2016: 23.4%

- Fiscal years beginning on or after 1 April 2018: 23.2%

Further, business tax rate (income component) is also reduced (6.0%→3.6%).

Thus, the standard corporate effective tax rate (the combined national and local

effective tax rate) is reduced from 32.11% (FY2015) to 29.97% (FY2016) and to

29.74% (FY2018). In the future, the government intends to reduce it to the level

of 20%.

※ The extension of special reduced tax treatment (15%, up to JPY8 million of

taxable income)for small and medium sized companies on or after 1 April 2017 is

not stipulated

(2) Revision of Depreciation

As measures to expand the tax base and secure financial resources caused by the

reduction of the corporate effective tax rate, the depreciation method for

structures and attachments to buildings is limited to straight line method from

1 April 2016 while declining balance method is no longer available.

(Note)Straight line method for lease period and replacement method are still

available.

(3) Revision of tax loss carryforwards

In the tax reform for 2015, the deductible ratio of tax loss carryforwards for

corporations or mutual companies with the amount of capital or contribution

JPY 500 million or more (large corporations) was already amended

(currently: 65%). In the 2016 tax reform, from the point of securing financial

resources and equalizing influences on corporate management, the deductible

ratio is further amended and reduced by 5% annually, starting from FY2016.

Also, the application of carry forward period of 10 years (currently: 9 years) is

delayed for one year.

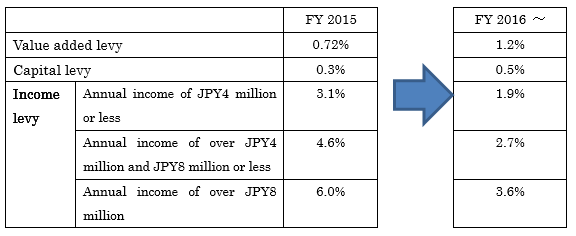

(4) Expansion of size-based business taxation and others

Size-based business tax system (for ordinary companies with the amount of capital

exceeding JPY100 million) was already reformed in the 2015 Tax Reform. The

standard tax rates under the 2016 Tax Reform are further increased as follows.

(The new tax rates are applied from fiscal years beginning on or after 1 April

2016.) Local corporate special tax, along with the decrease of business tax rate

(income portion), is amended from the current rate of 93.5% to 414.2%. (The new

tax rate is applied from fiscal years beginning on or after 1 April 2016.)

Please note that local corporate special tax is abolished and combined to business

tax from fiscal years beginning on or after 1 April 2017.

3. Conclusion

In this News, we provided the information about ‘the 2016 Tax Reform-Corporate Taxation’. We will focus on consumption tax and international taxation on the next News.

Please note that this News only introduces general guidelines of the content and does not include professional advice. So please make sure not to make any decisions without taking professional advice individually. If you have any questions, please do not hesitate to contact us.

(Reference)

The 2016 Tax Reform Proposals

Query on the phone+81-3-6821-9455